Running a business is no small feat. It requires careful planning, dedication, and an unwavering commitment to success. As a business owner, you invest countless hours, resources, and energy into building your empire. However, amidst the hustle and bustle of day-to-day operations, it’s crucial not to overlook a vital aspect of safeguarding your enterprise – business insurance.

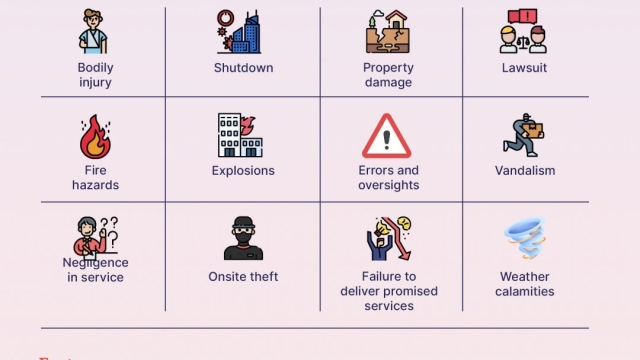

In the unpredictable world of business, risks can materialize from any angle. Whether you’re a contractor working on various projects or a homeowner managing a small consultancy firm, having comprehensive business insurance coverage in place can mean the difference between thriving and facing financial ruin. But with countless insurance options available, it’s easy to feel overwhelmed. That’s why we’ve created this ultimate guide to unravel the wonders of business insurance, helping you navigate through the complexities and make informed decisions every step of the way.

So, whether you’re just starting your entrepreneurial journey or looking to strengthen your existing business’s protection, this contractor insurance guide, business insurance guide, and home insurance guide will provide you with invaluable insights and practical tips to ensure your business remains resilient in the face of adversity. From understanding different types of coverage to evaluating your specific needs, we’ll shed light on the world of business insurance, empowering you to shield your hard-earned investments and secure a better future for your business.

Understanding Contractor Insurance

Contractor insurance is a vital aspect of protecting your business from potential risks and liabilities. As a contractor, you are aware of the unique challenges and potential hazards that may arise in your line of work. However, with the right contractor insurance coverage, you can ensure that your business is well-protected against unforeseen circumstances.

The first step in understanding contractor insurance is recognizing the different types of coverage available. General liability insurance is a fundamental component that provides coverage for property damage, bodily injury, and personal injury claims. It safeguards your business from legal responsibilities that may arise due to accidents or injuries on the job site.

Additionally, professional liability insurance, also known as errors and omissions insurance, is crucial for contractors who provide specialized services and advice. This coverage protects against claims of negligence, errors, or omissions that may result in financial losses for your clients.

Finally, consider workers’ compensation insurance, which is essential if you have employees. In the construction industry, accidents can happen, and having workers’ compensation coverage ensures that your employees are protected in the event of an injury or illness sustained while on the job.

Understanding the different types of contractor insurance coverage is key to selecting the right policies for your business. By adequately protecting yourself and your employees, you can confidently navigate the challenges and uncertainties that come with being a contractor.

Navigating Business Insurance

When it comes to protecting your business, having the right insurance coverage is crucial. Whether you’re just starting out or have been in business for years, understanding the ins and outs of business insurance can be daunting. This contractor insurance guide aims to demystify the world of business insurance and help you make informed decisions to safeguard your company’s future.

First and foremost, it’s important to identify the specific insurance needs of your business. Every industry and every company is unique, so there is no one-size-fits-all approach to business insurance. Consider the nature of your operations, potential risks, and the assets you want to protect. By assessing these factors, you can determine the types and levels of coverage that will best suit your business.

Next, familiarize yourself with the different types of business insurance policies available. From general liability insurance to professional liability insurance, there are various options to consider. A comprehensive business insurance guide will outline the main policies relevant to your industry and explain their purpose and benefits. Taking the time to understand these policies will enable you to make well-informed decisions when choosing the right coverage for your business.

Lastly, don’t forget to review your business insurance needs regularly. As your business grows, expands into new areas, or faces new risks, your insurance requirements may change. It’s essential to regularly reassess your coverage to ensure it continues to adequately protect your business. By staying proactive, you can adapt your insurance policies to align with the evolving needs of your company.

Navigating the world of business insurance may seem complex, but armed with the right knowledge and guidance, you can confidently protect your business and its future. This contractor insurance guide, along with other resources available, will equip you with the necessary information to make informed decisions and secure appropriate coverage for your specific needs. Remember, investing in business insurance today can potentially save you from significant financial losses tomorrow.

Securing Your Home with Insurance

When it comes to protecting your business, it’s important not to overlook the role your home plays in the equation. Whether you operate your business from a dedicated office space within your home or use it as a place to store important documents and equipment, it’s crucial to secure your home with insurance.

Contractor Insurance Guide: As a contractor, your home may serve as more than just a place of rest. It might house valuable tools, machinery, or supplies that are essential to your business operations. By obtaining proper contractor insurance, you can safeguard these assets in the event of damage or theft. Additionally, it provides liability coverage, protecting you from potential lawsuits.

Business Insurance Guide: Even if you don’t actively operate your business from home, having business insurance that extends coverage to your home can still offer valuable protection. This is especially true if you store inventory, paperwork, or sensitive customer information in your home. With business insurance, you can rest easy knowing that these assets are insured against unforeseen risks.

Home Insurance Guide: While you may already have homeowners or renters insurance, it’s important to review your policy to ensure it adequately covers your business-related assets and liabilities. Some home insurance policies may have limitations when it comes to covering business property or liabilities. By discussing your business needs with your insurance provider, you can explore options for obtaining the appropriate coverage.

Remember, securing your home with insurance not only protects your personal investment but also safeguards your business assets and helps mitigate potential risks. Take the time to evaluate your insurance needs and find the right coverage that suits both your business requirements and your home environment.