Getting auto insurance for your car is not only a legal requirement but also a smart financial decision. However, the cost of car insurance can sometimes be a burden on your budget. That’s where knowing the secrets of car insurance discounts can come in handy. By understanding the various factors that can affect your premium and taking advantage of available discounts, you can drive safe and pay less for your car insurance. In this article, we will delve into the world of car insurance and uncover the secrets to unlocking those coveted discounts. Whether you’re a seasoned driver looking for ways to save or a new car owner in need of guidance, this article will provide you with valuable insights on how to navigate the realm of car insurance discounts. So, let’s buckle up and explore the realm of homeowners insurance, car insurance, and auto insurance to discover how you can drive safe and pay less.

Understanding Car Insurance Discounts

Car insurance can be a significant expense for many motorists. However, understanding the various discounts available can help you save money on your coverage. Insurance companies offer a range of discounts to incentivize safe driving and reduce the risks they face. By taking advantage of these discounts, you can drive safe and pay less.

One of the most common types of car insurance discounts is the safe driver discount. This discount is often available to drivers who have maintained a clean driving record for a certain period of time. By avoiding accidents and traffic violations, you demonstrate responsible driving habits, which reduces the likelihood of future claims. Insurance companies reward safe drivers with lower premium rates.

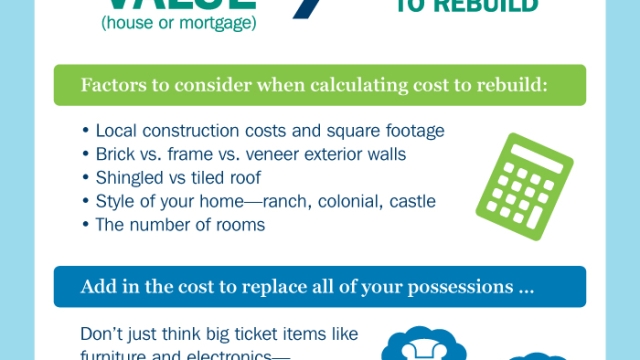

Another significant discount that can help you save on car insurance is the multi-policy discount. Many insurance companies offer homeowners insurance in addition to car insurance. By purchasing both policies from the same insurer, you may be eligible for a discount. Combining these policies not only simplifies your insurance management but also allows you to take advantage of cost savings.

Additionally, some insurance companies provide discounts for vehicles equipped with safety features. These can include anti-lock brakes, airbags, alarm systems, and more. By investing in these safety enhancements, you not only prioritize your well-being but also reduce the risk of accidents. Insurers acknowledge the reduced liability associated with such vehicles and may offer discounts accordingly.

Understanding the various car insurance discounts available can empower you to make informed decisions about your coverage. By maintaining a clean driving record, bundling policies, and equipping your vehicle with safety features, you can enjoy lower insurance premiums. Remember to inquire with your insurance provider about any other potential discounts available to maximize your savings.

Types of Car Insurance Discounts

When it comes to car insurance, there are several types of discounts that can help you save money on your premiums. Insurance companies offer these discounts as a way to reward responsible and safe driving habits. By taking advantage of these discounts, you can lower your car insurance costs while still maintaining the coverage you need.

One common type of car insurance discount is the good driver discount. This discount is often given to individuals who have demonstrated a clean driving record over a certain period of time. If you have avoided accidents and traffic violations, you may be eligible for this discount. Insurance companies view good drivers as low-risk and are willing to offer them lower premiums as a result.

Best Homeowners Insurance Michigan

Another discount to consider is the multi-policy discount. This discount is often available to individuals who have multiple insurance policies with the same company. By bundling your car insurance with other policies, such as homeowners insurance, you can often receive a discount on both policies. This not only saves you money but also streamlines your insurance coverage under one provider.

Additionally, some insurance companies offer discounts for certain safety features in your car. For example, if your car is equipped with anti-lock brakes, airbags, or an anti-theft system, you may be eligible for a discount. These safety features lower the risk of accidents and theft, making you a more appealing customer for insurance companies.

By being aware of the various types of car insurance discounts available, you can take steps to potentially reduce your premiums. Whether it’s maintaining a clean driving record, bundling policies, or equipping your vehicle with safety features, these discounts can make a significant difference in your overall insurance costs. Take the time to explore your options and see how you can drive safe while paying less for your car insurance.

Tips for Maximizing Car Insurance Discounts

-

Safe Driving Habits:

Maintaining a clean driving record is one of the most effective ways to secure car insurance discounts. Avoiding accidents and traffic violations not only keeps you safe on the road but also demonstrates to insurers that you are a responsible driver. By adhering to speed limits, using turn signals, and obeying traffic laws, you can increase your chances of qualifying for significant discounts on your car insurance premiums. -

Bundling Homeowners and Auto Insurance:

If you own a home, consider bundling your homeowners and auto insurance policies with the same provider. Many insurance companies offer discounts to customers who have multiple policies with them. By consolidating your coverage, you may be able to enjoy lower premiums for both your home and car insurance. It’s worth checking with your insurance company to see if they offer such bundled discounts. -

Installing Safety Features:

Equipping your vehicle with safety features can also help lower your car insurance rates. Many insurers provide discounts for cars that have anti-theft devices, airbags, rearview cameras, and other safety features. These technologies reduce the risk of accidents and theft, making your vehicle less of a liability in the eyes of insurance companies. Installing such safety features not only protects you and your passengers but can also contribute to significant savings on your car insurance premiums.

Remember, maximizing car insurance discounts requires consistent effort and staying proactive. Other factors that can potentially lower your premiums include maintaining a good credit score, driving less frequently, and completing defensive driving courses. To ensure you receive the best possible rates, it’s advisable to regularly review your policy and explore any new discounts that may be available to you.