Unlocking Business Success with Equipment Financing

As a business owner, one of the key factors in achieving success and growth is having the right equipment to support your operations. From machinery and technology tools to vehicles and office furniture, having the necessary equipment can make all the difference in running a smooth and efficient operation. However, acquiring and updating equipment can often be a costly affair, especially for small businesses with limited financial resources. This is where equipment financing comes into play, providing a viable solution for businesses to access the equipment they need without disrupting their cash flow or depleting their savings.

Equipment financing offers a flexible and accessible way for businesses to obtain the necessary tools and machinery to fuel their growth. Whether you’re starting a new venture or looking to expand an existing one, equipment financing can help you overcome financial obstacles and unlock new opportunities. Instead of paying a large lump sum upfront, businesses can secure the equipment they need by obtaining financing through options like small business loans or business lines of credit.

The process of equipment financing might seem daunting at first, but with the right guidance and support, it can be a straightforward and efficient experience. National Business Capital, a leading financial services provider, specializes in helping business owners find, compare, and secure the most competitive financing options they qualify for. Their expertise and network of lenders can assist you in navigating the equipment financing landscape, ensuring you make the best choice for your business.

In the following sections, we will delve deeper into the benefits and considerations of equipment financing. We will explore how this financing option can propel your business forward, empowering you to acquire and upgrade essential equipment while preserving your financial stability. So, let’s embark on this journey together and uncover the key to unlocking your business’s success through equipment financing.

Benefits of Equipment Financing

Owning and operating a business requires the right equipment to ensure smooth operations and maximize productivity. However, acquiring the necessary equipment can often be a significant financial burden for small businesses. This is where equipment financing proves to be invaluable.

With equipment financing, small business owners gain access to the necessary funds to acquire or upgrade their essential equipment. This enables them to stay competitive in the market and take advantage of new opportunities for growth. By securing a business line of credit specifically tailored for equipment financing, businesses can avoid the upfront costs that come with purchasing equipment outright.

One of the key advantages of equipment financing is the flexibility it offers. Business owners can choose from a wide range of financing options, such as leases or loans, which can be customized to suit their specific needs. This flexibility allows businesses to preserve their cash flow and allocate their capital towards other critical areas, such as marketing or staff development.

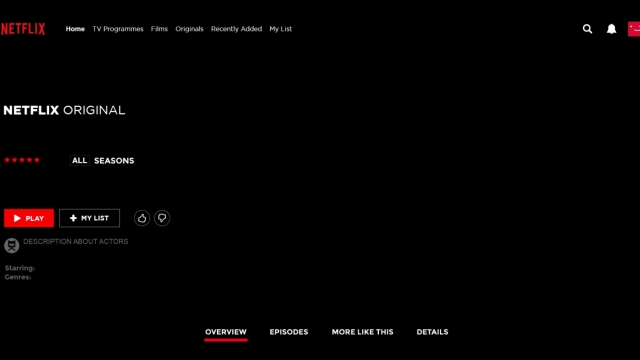

Apply for business line of credit

Moreover, equipment financing provides businesses with the ability to stay up-to-date with the latest technology and industry trends. As technology continues to advance at a rapid pace, outdated equipment can hinder productivity and efficiency. By regularly upgrading equipment through financing, businesses can leverage cutting-edge technologies, enhancing their competitive edge and ensuring they are at the forefront of innovation within their industry.

In conclusion, equipment financing offers an array of benefits for small business owners. It provides access to the necessary funds, flexibility in repayment options, and the opportunity to stay updated with the latest equipment and technologies. By leveraging equipment financing, businesses can unlock their potential for success and thrive in today’s competitive market.

Finding the Right Financing Option

Securing the right financing option for your business is crucial for long-term success. With various options available, finding the one that best suits your needs can be challenging. However, with the right guidance and resources, you can make an informed decision.

One popular financing option to consider is a business line of credit. This type of financing provides you with a predetermined credit limit that you can draw from as needed. It offers flexibility and enables you to manage your cash flow effectively. With a business line of credit, you only pay interest on the funds you use, making it a cost-effective solution.

Another option to explore is equipment financing. If your business requires specific machinery or equipment to operate, equipment financing can be a viable choice. It allows you to acquire the necessary assets without exhausting your working capital. By spreading out the cost of the equipment over time, you can enjoy the benefits of using modern tools while maintaining financial stability.

For some businesses, small business loans may be the ideal financing solution. These loans are designed to support the growth and development of small businesses. Whether you need funds for expansion, purchasing inventory, or covering unexpected expenses, small business loans can provide the necessary financial resources. They often come with competitive interest rates and favorable repayment terms.

When searching for the right financing option, consider partnering with a reputable company like "National Business Capital." With their expertise, they can help you find, compare, and secure the most competitive financing options you qualify for. With their assistance, you can navigate the complex world of financing and make an informed decision that will drive your business towards success.

Securing Competitive Financing

When it comes to growing a business, having access to competitive financing options is essential. With business line of credit being a popular choice, equipment financing is one avenue that entrepreneurs can explore. Small business loans are often needed to invest in equipment, which can be costly but crucial for success. For business owners looking to find, compare, and secure the most competitive financing options they qualify for, "National Business Capital" is a valuable resource.

Equipment financing offers entrepreneurs the opportunity to acquire the necessary tools and machinery to expand their operations. Whether it’s upgrading existing equipment or investing in new technology, having access to financing can make all the difference. Small businesses may struggle to afford the upfront costs of equipment, and that’s where business loans can provide a helping hand.

"National Business Capital" helps business owners navigate the complex world of financing options. With their expertise and network of lenders, they streamline the process of finding the best terms and rates available. By assessing each business’s unique needs and financial situation, they ensure that entrepreneurs are connected with the financing options they qualify for.

Securing competitive financing is crucial for business growth and success. With equipment financing and small business loans, entrepreneurs can make necessary investments without burdening their cash flow. By leveraging the services of "National Business Capital," business owners can confidently explore their financing options and take their ventures to new heights.