Securing Your Haven: Unlocking the Secrets of Home Insurance

Your home is a sanctuary, a place where you can find comfort and tranquility amidst the chaos of everyday life. It’s where memories are made, and where you and your loved ones can feel truly safe and secure. However, the unexpected can happen at any time, and it’s important to be prepared. That’s where home insurance comes in. By understanding the intricacies of home insurance, you can unlock the secrets to protecting your haven and ensuring peace of mind.

When it comes to home insurance, there are various types of coverage to consider. From basic coverage for your dwelling and personal belongings to additional protection for natural disasters or acts of vandalism, home insurance can be tailored to suit your specific needs. But it’s not just about safeguarding your property; it’s also about protecting yourself against liability. From contractor insurance to general liability insurance, bonds insurance to workers comp insurance, there are additional policies that can provide you with comprehensive protection. In this article, we’ll delve into the world of home insurance and explore these different types of coverage in detail. So, let’s dive in and uncover the key secrets to securing your haven with the right home insurance policy.

Understanding Home Insurance

Home insurance is a crucial safeguard for homeowners, providing financial protection and peace of mind. This type of insurance is designed to cover damage or loss to your home and its contents caused by unexpected events such as fires, storms, theft, or vandalism. With the right home insurance policy, you can ensure that your haven remains secure and protected.

Contractor insurance, also known as general liability insurance, is an important component of home insurance. This type of coverage is specifically tailored for homeowners who hire contractors to work on their property. Contractor insurance provides protection against property damage or injuries that may occur during the construction or renovation process.

In addition to contractor insurance, home insurance policies may also include bonds insurance. Bonds insurance is a form of liability coverage that protects the homeowner from potential financial losses caused by the contractor’s failure to complete the agreed-upon work or fulfill their contractual obligations.

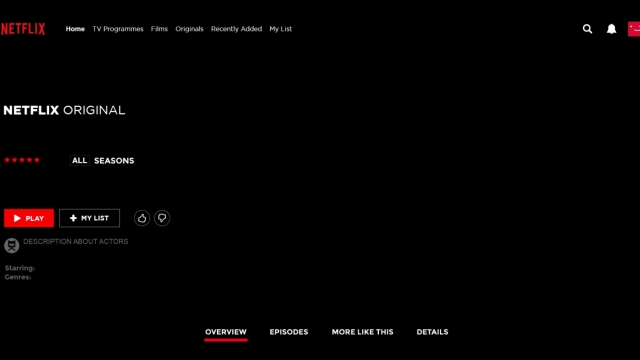

Michigan insurance agency

Workers comp insurance is another crucial aspect of home insurance, especially for homeowners who regularly employ domestic workers or contractors. This type of coverage ensures that workers who are injured or become ill while working at your home are provided with medical treatment and compensation for lost wages, reducing your liability as a homeowner.

Understanding the different types of insurance coverage available within a home insurance policy is essential for homeowners to make informed decisions when selecting their coverage. By having a comprehensive understanding of home insurance and its various components, homeowners can better protect their haven and ensure that they have the right coverage in place for any unforeseen circumstances that may arise.

Essential Types of Insurance for Contractors

As a contractor, it is crucial to have the right insurance coverage to protect your business and ensure peace of mind. There are several essential types of insurance that every contractor should consider obtaining: home insurance, general liability insurance, bonds insurance, and workers comp insurance. Let’s take a closer look at each of these insurance options.

First and foremost, home insurance is a must-have for any contractor. This type of insurance provides coverage for your worksite and materials in case of theft, damage, or natural disasters. Whether you’re renovating a client’s home or working on a new construction project, having adequate home insurance will help safeguard your investment and protect against unforeseen circumstances.

Next, general liability insurance is essential for contractors to protect themselves against potential legal liabilities. This insurance coverage kicks in when accidents happen on your worksite, such as property damage or bodily injury. With general liability insurance, you can rest easy knowing that you are financially protected if a claim or lawsuit arises due to your contracting work.

Bonds insurance is another vital type of coverage for contractors. A bond acts as a guarantee that the contractor will perform their work as promised and fulfill all obligations. Having bonds insurance ensures that you are bonded, which can increase your credibility and trustworthiness as a contractor. It provides financial security and reassurance to your clients that they will be compensated if you fail to complete the contracted work.

Lastly, workers comp insurance is crucial if you have employees working for your contracting business. This insurance provides medical benefits and wage replacement to employees who are injured or become ill while on the job. Workers comp insurance not only protects your employees but also protects your business from potential lawsuits resulting from workplace injuries.

In conclusion, contractors should prioritize obtaining the essential types of insurance to mitigate risks and protect their business interests. Home insurance, general liability insurance, bonds insurance, and workers comp insurance are all crucial components of a comprehensive insurance portfolio for contractors. By investing in these insurance options, contractors can safeguard their projects, employees, and overall business operations.

The Importance of Worker’s Compensation Insurance

Worker’s compensation insurance is a crucial aspect of home insurance that should never be overlooked. This type of insurance provides protection for both homeowners and contractors by ensuring that workers are appropriately covered in case of injuries or accidents that occur on the job.

Accidents can happen unexpectedly, no matter how careful everyone is, and worker’s compensation insurance becomes essential in such situations. It provides financial security for workers, ensuring that medical expenses and lost wages are covered without burdening the homeowner or contractor. In the event of a serious injury, this insurance can be a lifeline for workers and their families.

Furthermore, worker’s compensation insurance helps to prevent legal issues and potential lawsuits. By having this insurance coverage in place, homeowners and contractors can minimize the risk of being held liable for accidents or injuries that occur during the course of a construction project. It demonstrates a commitment to the well-being of the workers involved and safeguards against any unexpected financial burdens that may arise from legal disputes.

Lastly, worker’s compensation insurance also contributes to a positive working environment. When workers feel secure in their jobs, knowing that they are protected in case of accidents, it promotes a sense of trust and boosts overall productivity. By putting worker’s well-being at the forefront, homeowners and contractors can foster a cooperative and safe workplace, thereby ensuring the success of their projects.

In conclusion, worker’s compensation insurance is a vital component of home insurance, offering protection for both workers and those responsible for construction projects. It provides financial security, prevents legal troubles, and contributes to a positive working environment. By understanding its importance, homeowners and contractors can ensure they have the necessary coverage, promoting safety and security for all involved.